Learn About Tax Amnesty and Other Special Projects

What Are Tax Amnesty Programs?

These are limited-time opportunities for individuals and businesses to repay their delinquent tax debts without financial or criminal penalties. The programs also may include additional compliance incentives.

Why Do States Offer Tax Amnesty Programs?

States can use the revenue from these programs to address urgent budget gaps and return funds to their communities and initiatives. The programs can be implemented quickly and deliver immediate revenue, so states may turn to them when budget deficits are large or when budgets have been impacted by crises.

Individuals and businesses can meet their obligations and avoid penalties, lowering the financial impact on their personal budgets.

Where Can I Learn About Other States’ Programs?

Pioneer Credit Recovery offers free consultation for amnesty programs, including insights from the many we have administered.

For more context, check out this list of programs maintained by the Sales Tax Institute.

What Are Some Best Practice Considerations for Tax Amnesty Programs?

We’re glad you asked. Discover our 10 best practices for tax amnesty success.

Why Choose Pioneer Credit Recovery as Your Tax Amnesty Partner?

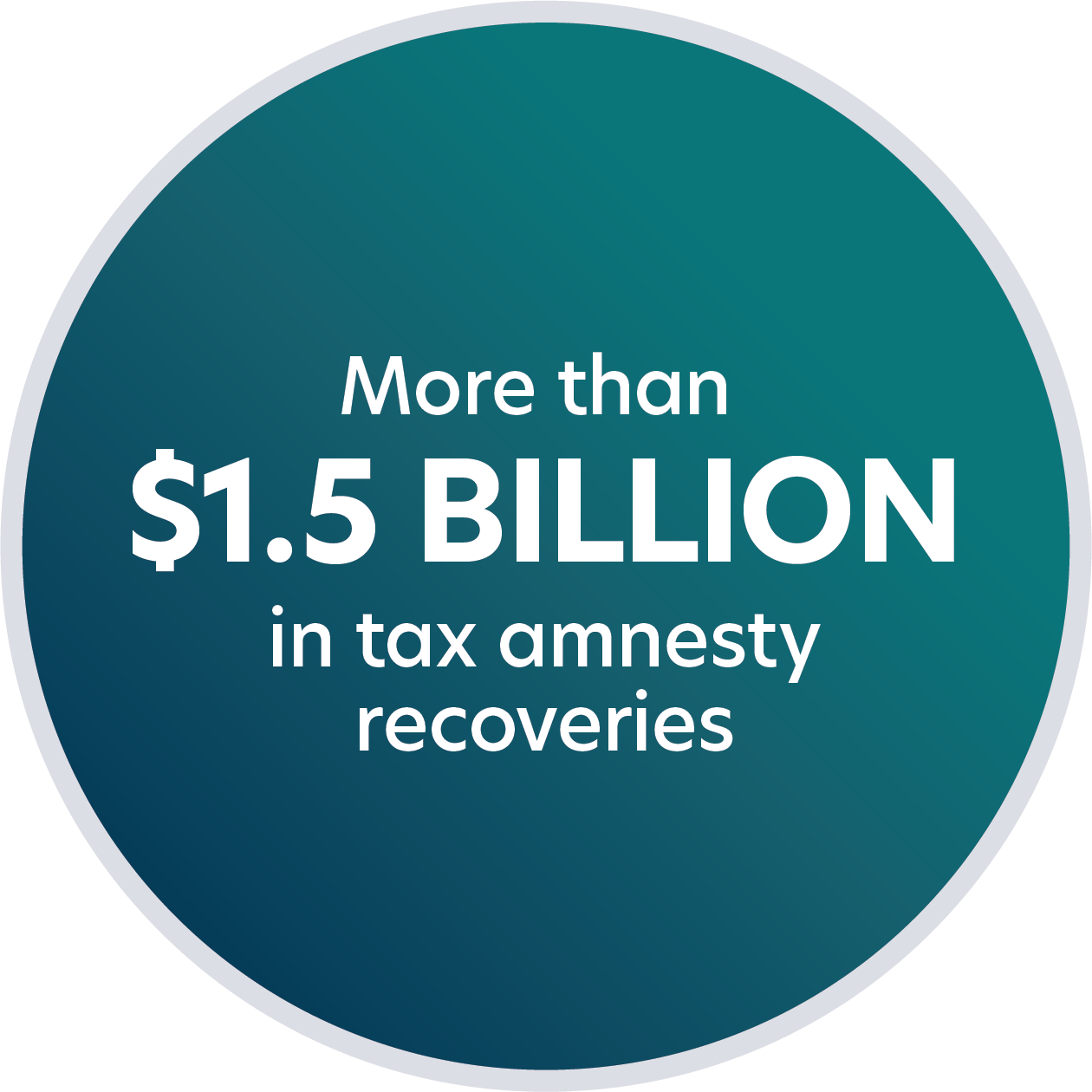

Experience: Pioneer has helped states administer successful tax amnesty programs, recovering more than $1.5 billion in the past several years and regularly exceeding clients’ expectations. We have experience with all types of tax debts.

Scale and agility: With hundreds of employees – and as part of Business Processing Solutions, LLC, one of the nation’s leading providers of CX outsourcing solutions – we bring a unique combination of scale, technology, agility, stability, and compliance.

End-to-end solutions: Pioneer can administer all key aspects of a tax amnesty program.

Consulting: Best-practice, pre-program guidance tailored to your unique situation, goals, demographics, and debt portfolio

Customer contact center: Handling inbound calls and providing transactional support for billing, payment and document processing, benefit eligibility, and websites

Audience engagement: Ensuring constituents, staff, and state leadership are informed about the program, its benefits, its timeline, and how to participate

Post-event reporting: Making sure final results are clear and complete.

Ethics: Our enterprise is committed to making our world a better place. Learn more about our commitments to corporate social responsibility.

What Are Key First Steps for States Interested in Exploring a Tax Amnesty or Other Special Project?

Contact us today to schedule a meeting and begin discussing your goals, debt portfolio, and demographics. Creating a smart strategy now will help optimize eventual outcomes.

We can share sample legislation from prior programs, plus tailored program design consultation. We provide start-to-finish support, including collaboration with key stakeholders to secure pre-vote buy-in.

We also can estimate the revenue you may recover, based on how you plan to structure your program.